LendingTree is made up by business on this website as well as this compensation may affect how and where provides appears on this website. LendingTree does not include all loan providers, cost savings products, or car loan alternatives available in the industry. LendingTree is compensated by firms on this site and also this compensation may affect exactly how as well as where offers show up on this website. A variable price home loan is defined as a kind of home loan in which the interest rate is not taken care of. Lots of property owners entered financial problem with these kinds of home loans during the housing bubble of the very early 2000s. Negative credit history or no credit report, a lender may ask a potential consumer to find a co-signer for the home mortgage.

Also, variable price loans use a great deal of flexibility compared to fixed-rate home loans. This indicates you can include attributes to your home mortgage like the capability to make additional payments and have accessibility to a countered sub-account. Real estate tax have to be paid when you own a home, and also they're usually included in your monthly mortgage payment. Most property owners pay a little every month as part of their mortgage repayment that enters into an escrow account the lender sets aside to cover the tax obligations.

In 2021, 87% of all residence buyers had home loans as well as 96% of newbie house buyers utilized a home loan, according to information from the National Association of Realtors. Don't require a down payment and also are offered to homebuyers who meet earnings requirements in assigned country and suburban areas. Debtors with credit scores as low as 580 may get approved for an FHA-insured home loan with a deposit of a minimum of 3.5%. Home mortgage insurance policy premiums might be billed in your month-to-month home mortgage statement.

- Nevertheless, these must only be thought about a last resort as they normally really high rate of interest as well as fees.

- Federal government teams do not back portfolio financings, so there are no conventional means of approval.

- You'll likewise be able to choose the finance term, or the length of time you'll need to settle the mortgage.

- If you're preparing to acquire a home, odds are you'll need a home mortgage.

- Connect with a real estate agent to start seeing homes in your location.

This program is for debtors who have actually remained present on mortgage settlements previously. Origination charge-- Along with the application or handling fee, the loan provider might likewise bill an origination cost. This covers the added job the lender needs to do when preparing your mortgage. If the fee is a percent of the loan, then it is typically taken into consideration a "price cut factor" in camouflage. This alters the tax ramifications and also More help your prices, so make sure to ask the lending institution regarding this charge.

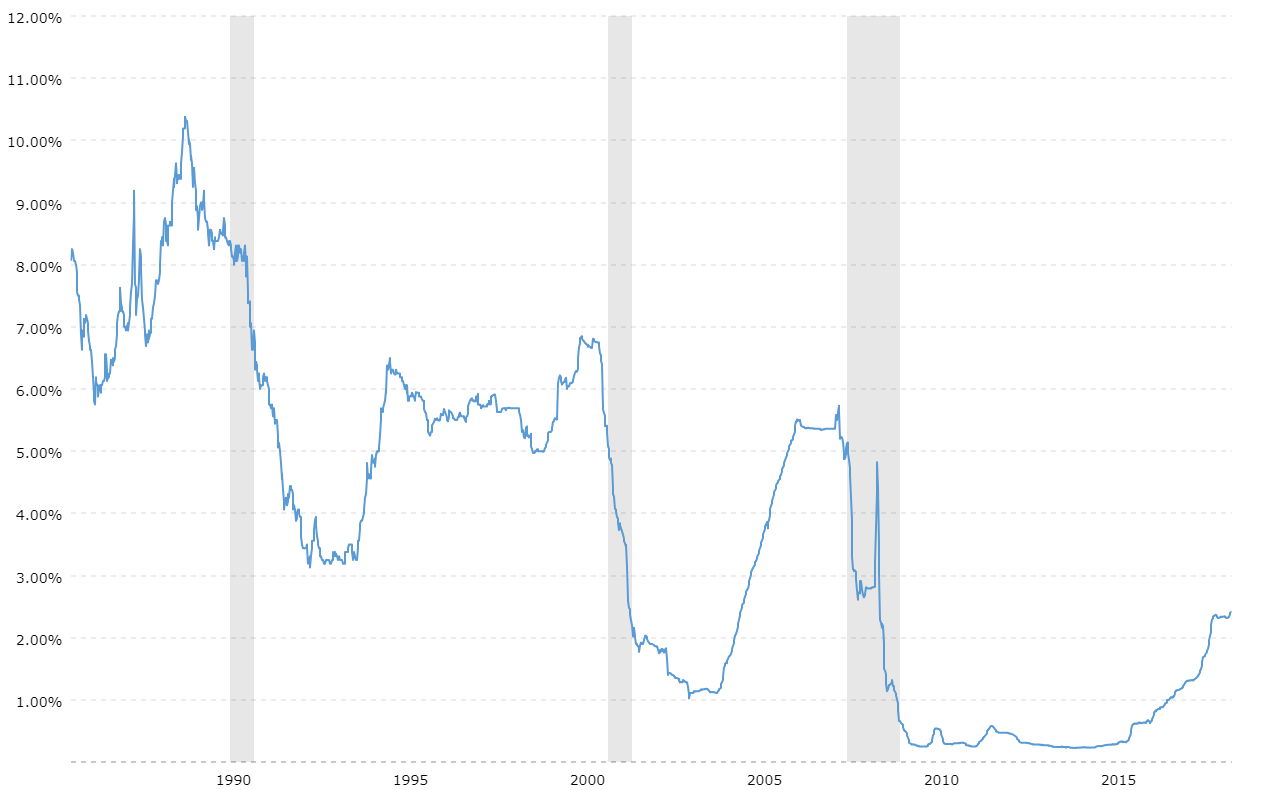

Flexible Rate Home Mortgages

The average home price across the UK has remained fairly high as well as is presently around ₤ 228,000. HSBC is among the biggest loan providers in the UK, supplying a series of award-winning, fantastic value mortgages for people looking for a house or a buy to let Visit this link property. If you're taking into consideration purchasing a house in the UK, learn about mortgages in the UK and also what you'll require to get one. You'll repay your home mortgage faster by making an additional month's payment annually.

A Straightforward Definition Of A Home Mortgage

You may just need to talk with more lenders or go for a greater rates of interest. In the next area, we'll explain what sort of credit report and also income capability you'll require to pass the lender's history check. The length of time you're really in the house prior to you offer or re-finance straight influences the reliable interest rate you eventually get. If you live in a backwoods or small town, you may get a low-interest funding through the Rural Real Estate Solution.

They are created for homeowners age 62 or older who want Find out more to convert part of the equity in their houses right into cash. ARMs usually have limits, or caps, on just how much the rate of interest can rise each time it changes and also in total over the life of the funding. If you stop working to support the duties laid out in the cosigned promissory note (e.g., pay back the money you borrowed), the lender can take possession of the residential property. VA fundings charge a funding cost that can be rolled into the car loan as component of the home mortgage. The quantity of money you can obtain will rely on what you can reasonably afford as well as, most notably, the fair market price of the home, determined through an appraisal.

We likewise reference initial research from various other trustworthy authors where suitable. You can discover more concerning the criteria we follow in creating precise, objective web content in oureditorial plan. Mortgages are offered in a selection of types, consisting of fixed-rate and also adjustable-rate. We've produced an easy-to-understand directory site of the most common home loan terms.

Again, 30 years is the most common, however you'll possibly additionally see alternatives for 20- and 15-year home loans. -- which can cover damage to your home from fires, tornados, accidents and also various other catastrophes-- is generally needed by home loan lending institutions. They might collect a part of your costs as component of your mortgage payment and afterwards pay the insurance expense out of your escrow account when it's due. You may have some alternatives if you locate yourself battling to stay on par with your monthly home loan payments.